Over 2.3 Million Products Recalled, Power Banks Bid Farewell to Low-Price Rush, CR10 Rises to 45.9%

By Industry Research Team

Since June, a continuous series of power bank safety incidents has swept through the entire industry.

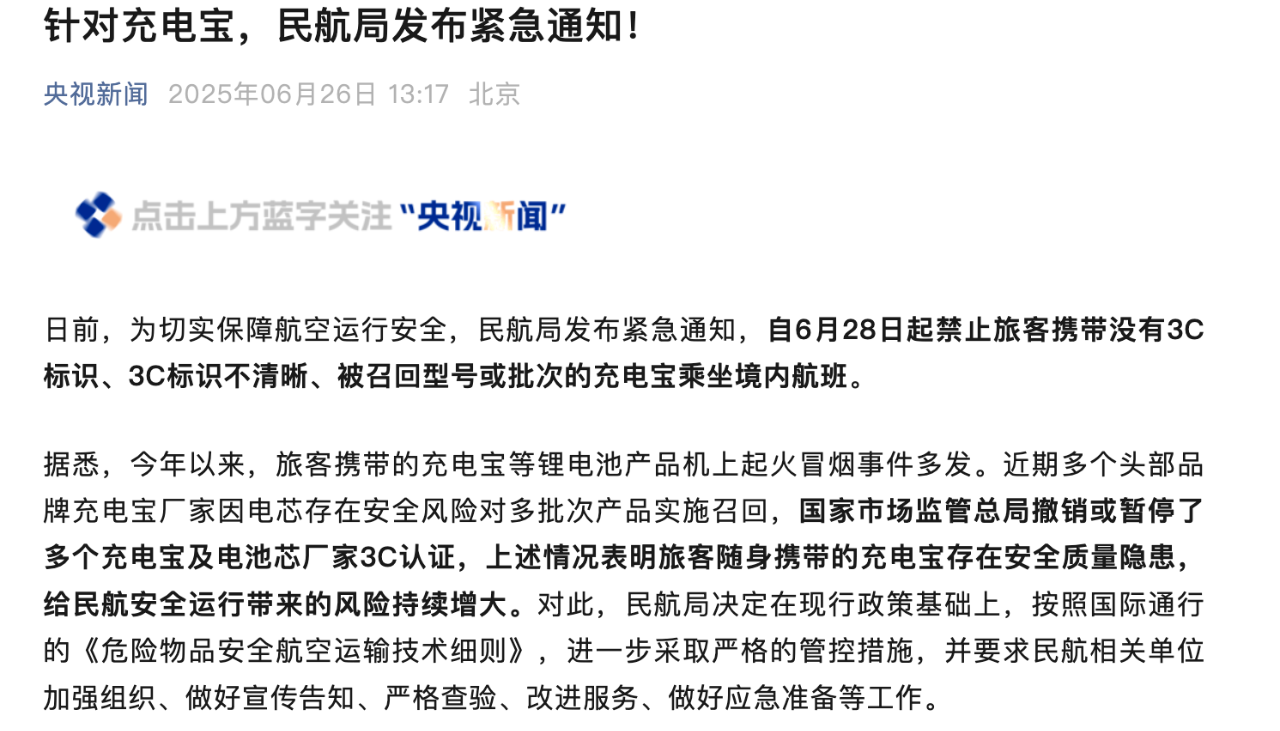

On June 26, the Civil Aviation Administration issued an urgent notice prohibiting passengers from carrying power banks without a 3C mark, with unclear 3C marks, or those that have been recalled on domestic flights, directly targeting the main brands involved in the power bank recall incidents—罗马仕 and 安克, causing significant losses for many passengers.

This crisis has not only plunged consumers into “power bank anxiety” but has also exposed long-standing supply chain risks and quality control loopholes in the industry.

To date, the mobile power supply industry has reached a market size of ten billion dollars (globally in 2023), with China holding more than 30% of the share. Both the consumer and production sides of the Chinese market play a crucial role. The power bank industry is now facing the dual test of domestic and overseas markets.

For brands, this crisis may become an opportunity for reshuffling.

I. Frequent Safety Accidents, Over 2.3 Million Products Recalled

The storm that swept the mobile power market began to show signs at the beginning of this year.

Since March, there have been frequent incidents of power banks self-igniting on flights, one of which was caused by a 罗马仕 20000 mAh power bank.

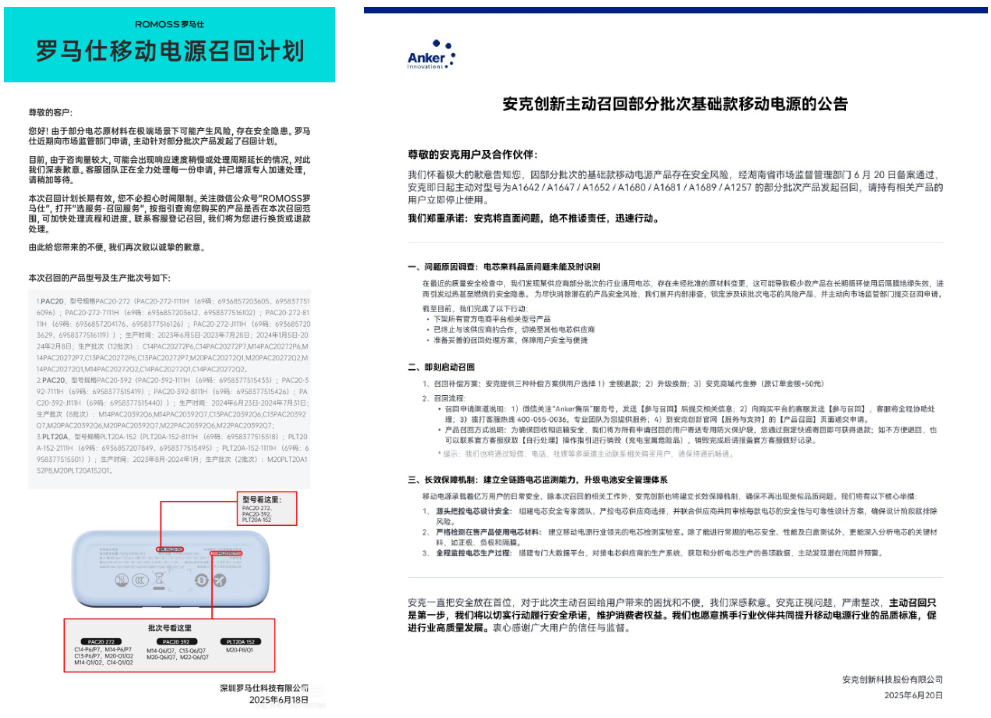

In early June, several universities in Beijing issued notices banning the use of 罗马仕 high-capacity power banks, citing a higher probability of self-ignition. Subsequently, 罗马仕 quickly issued a statement to refute the rumors, claiming that they had not received any risk notice from the Beijing Municipal Education Commission. However, on June 14, just four days after the announcement, 罗马仕 announced the official launch of a mobile power source recall plan, involving over 490,000 units.

Coincidentally, 安克 also initiated a large-scale power bank recall plan in June, starting in the brand’s main overseas market, the United States. According to the U.S. Consumer Product Safety Commission disclosed on June 12, the number of 安克 PowerCore10000 power banks recalled in the U.S. reached 1.158 million units.

Subsequently, 安克 also started product recalls in China, involving some batches of seven models, most of which were best-selling models on mainstream e-commerce platforms, with an estimated number of 713,000 units. At the same time, the brand removed the problematic products from all platforms.

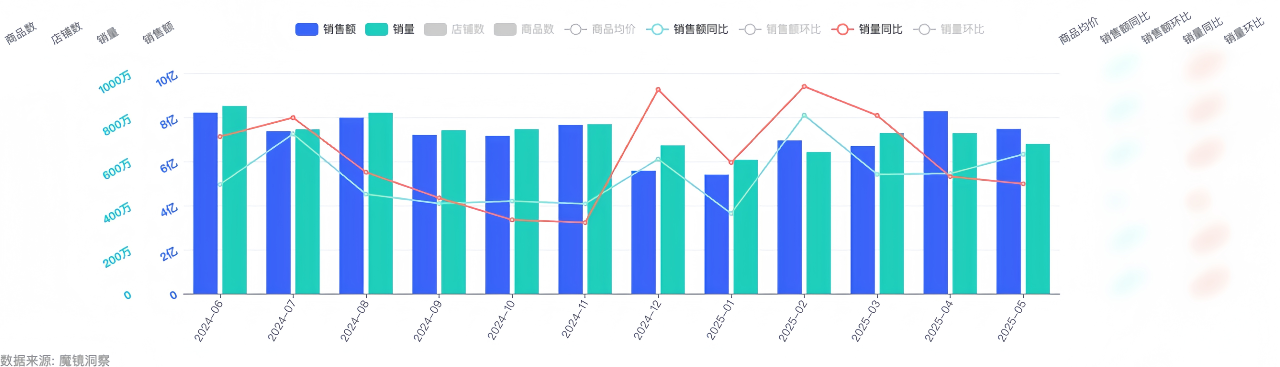

For a long time, 安克 and 罗马仕 have been leading in both domestic and overseas markets. According to Moojing Market Intelligence data, from June 2024 to May 2025, 罗马仕 became the TOP1 brand in the online power bank market with a 13.3% market share, focusing on cost-effectiveness, with an average product price of 129.1 yuan. 安克 ranked third with a 5.8% market share, with an average product price of 268.8 yuan, targeting the mid-to-high-end market.

However, with the unfolding of product recalls and the revocation of 3C certifications, the industry reshuffle has already begun. Currently, 罗马仕 has closed all online stores and announced a six-month shutdown starting from July 7, casting a pessimistic outlook for the brand’s future development.

On the other hand, 安克’s power bank sales volume significantly decreased in June, but sales revenue increased by 50% year-on-year. Despite the impact of removing problematic products and recall events on 安克’s sales, the brand seized opportunities amid market fluctuations with selling points such as “new national standard 3C certification” and “airplane carry-on,” driving the month’s transaction volume with high unit price products.

II. Originating from Battery Cells? The Involution and Loss of Control in the Power Bank Market

The proliferation of smartphones has provided ample usage scenarios and user demand for the power bank market, which has seen rapid expansion in market size over the past decade.

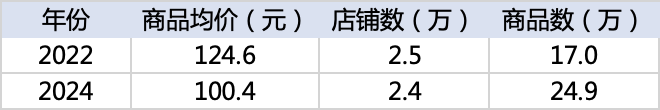

A large number of players have entered the mobile power supply market. According to Moojing Market Intelligence data, in 2024, there were as many as 25,000 related stores on mainstream e-commerce platforms, with 249,000 products, a 46.4% increase from 2022.

The intense market environment has led brands to become involved in an involution of specifications and prices—larger capacity, smaller size, cheaper price. In 2024, the average online price of power banks dropped from 124.6 yuan two years ago to 100.4 yuan, at the same time, the average price of 20000mAh high-capacity power banks also decreased by 12.9%, coming to 94.6 yuan. The vicious competition of low prices ultimately led to safety incidents.

The reason for the recalls by both companies points directly to “battery cells.” It is reported that due to a supplier’s “unauthorized change of raw materials” in the manufacturing of battery cells, there is a risk of self-ignition under extreme conditions. Although the brands did not specify the supplier involved, media investigations indicate that the source of the recall incidents is the well-known battery cell supplier 安普瑞斯 (Wuxi).

The cost of battery cells in mobile power sources accounts for more than 60% of the total cost, and industry insiders also point out that the frequent quality issues with power banks are related to some manufacturers purchasing low-cost battery cells to save costs.

The power bank industry generally adopts the supply chain model of “brand owner—OEM factory—battery cell supplier.” Whether upstream or midstream, there is a common presence of OEM factories. This outsourcing model has planted two hidden dangers for the industry:

On one hand, OEM factories, in order to profit, may cut raw material costs or outsource production to smaller factories;

On the other hand, brands have blind spots in product testing, making it difficult to pinpoint problems, whether in terms of process or technology.

In a recent exclusive interview with 知危, 熊康, the person in charge of charging and energy storage business, stated that the power bank recall incident indeed occurred because the brand did not identify the problem with the battery cells in time; moreover, most power bank companies, including the past 安克, do not have the capability to disassemble battery cells and analyze materials.

Additionally, media reports indicate that the current quality issues with power banks are related to the fact that the mandatory 3C certification for mobile power supplies in China only began to be implemented in August 2024. Also, before May of this year, the certification process adopted a “certificate first, factory inspection later” model, which could lead to discrepancies between the sample submitted for certification and the mass-produced products.

As of July 3, the State Administration for Market Regulation has suspended 5,269 3C certificates related to power banks and revoked 343, involving multiple brands such as 罗马仕, 安克, and 品胜. At the same time, all 74 3C certifications of the battery cell supplier 安普瑞斯 have been suspended or revoked.

This widespread revocation of certificates also exposed loopholes in past institutional certifications and brand quality inspection processes.

III. Accelerated Reshuffling, Bidding Farewell to the Era of “Low Price for Market Share”

The proliferation of smartphones has provided ample usage scenarios and user demand for the power bank market, which has seen rapid expansion in market size over the past decade.

The series of safety incidents involving power banks have slammed the brakes on the industry’s low-price race, elevating safety and quality supervision to an unprecedented level.

For leading brands, optimizing the supply chain and upgrading testing technology have become key focuses for subsequent improvements.

In the exclusive interview with 知危, 熊康 stated that 安克 has now invested a significant amount of manpower and funds to build a battery cell laboratory and a traceability platform to ensure the reliability of each battery cell and the traceability of each product throughout the entire process. On top of optimizing suppliers, more demands are being made on existing suppliers, such as transmitting all data during the production process for timely monitoring and analysis.

At the same time, 安克 is synchronizing recall progress on its official website and social media, offering consumers three compensation options: “refund, replacement, or voucher,” making the utmost effort to regain user trust through a series of public relations measures.

熊康 mentioned that although 安克’s NPS (Net Promoter Score) is currently declining, about 70% of users during the recall process chose to exchange or receive a voucher, with most consumers opting to continue trusting the brand. The sales situation of 安克 power banks in June also indirectly confirms the market’s affirmation of the brand, which still ranks third in the online market.

After the turmoil in June, the power bank market has welcomed a major reshuffle. According to Moojing Market Intelligence data, the top two brands in the online mobile power market in June were 倍思 and 小米, with sales growth rates both exceeding 75%. At the same time, backed by the Xiaomi ecosystem, ZMI, leveraging the popularity of 苏超, quickly became popular, with sales volume surging by 125% month-on-month, jumping to the sixth place on the brand list.

After the Implementation of New Regulations, 3C Certification Becomes a Major Marketing Selling Point, with Related Product Searches Surging by 120%. Leading Brands Expand Market Share Through Advantages in Supply Chain Management, R&D Strength, and Flexible Product Strategies. In June, the Online Power Bank Market’s CR10 Market Share Increased from 44.8% Over the Past Rolling Year to 45.9%, Further Concentrating the Market Towards Leading Brands, with Small and Medium-Sized Enterprises Unable to Meet Relevant Qualification Certifications Facing Elimination.

It Is Worth Noting That Product Prices Have Significantly Increased, Creating Profit Margins for Brands. Moojing Market Intelligence Data Shows That the Average Price of Online Power Banks in June Was 114.1 Yuan, an Increase of Nearly 16% Over the Previous Rolling Year.

In the Future, the Replacement in the Mobile Power Supply Industry Will Continue to Accelerate, Which Is Both a Test and an Opportunity for Brand Manufacturers. Quality Control Will Become the Core Competitiveness of Brands, and Surviving Enterprises Will Welcome a Healthier Growth Cycle.

No Data for Market Research? Try the Thoughtful Mirror World AI! Integrating Moojing E-commerce Data for One-Click Market Analysis! Free Trial on PC: ai2.mktindex.com