MoAnalysis

Industry benchmark competitive sales monitoring to identify trend opportunities and enhance brand market share. Track 400,000+ brands across 30+ marketplaces spanning 10 platform ecosystems in 20+ countries with SKU-level granularity.

Pair with MoListening for consumer sentiment or MoTrends for opportunity forecasting.

Global Platform Coverage

APAC specialists with 10+ years of China market data depth, now expanding globally across 20+ countries. Monthly refresh cycles across all platforms with complete sitewide or targeted coverage.

Platform Coverage

We provide comprehensive sitewide tracking across China's major e-commerce platforms:

- Historical Depth: 10+ years of data for China's largest marketplaces

- Update Frequency: Daily SKU-level tracking

- Coverage Scope: 58-65% of China's total e-commerce GMV

- Social Commerce: Comprehensive tracking since 2022

Monitoring emerging social commerce across:

- Southeast Asia: 6 markets with comprehensive tracking

- North America: US and Canada social commerce channels

- Europe: UK and major European markets

- Update Frequency: Real-time to weekly updates

- Expanding: New markets added monthly

Our international coverage includes:

- 30+ major platforms across 20+ countries

- Monthly updates for all markets

- Multi-year historical data for key regions

- SKU-level tracking across categories

North America

United States, Canada, Mexico

Europe

United Kingdom, Germany, France, Italy, Spain, Netherlands, Poland

Asia-Pacific

Japan, Singapore, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Australia

Middle East

UAE, Saudi Arabia

Latin America

Brazil, Argentina

Other Markets

Russia, Hong Kong, Taiwan, and expanding

Total Platforms

30+ major e-commerce and social commerce platforms

Countries Covered

20+ markets worldwide

Historical Data

Up to 10+ years for major markets

Update Frequency

Daily to monthly depending on market

Data Granularity: SKU-level tracking with product attributes, pricing, reviews, ratings

We support custom platform collection for:

- Additional China domestic marketplaces

- Vertical e-commerce platforms (health, luxury, B2B)

- Emerging social commerce channels

- Regional specialty platforms

Enterprise teams can access custom data via our MoInsights+ API.

Need Even More Coverage?

We support custom platform collection for additional domestic and international marketplaces, vertical e-commerce platforms, and emerging channels. Enterprise teams can access this data via our MoInsights+ API.

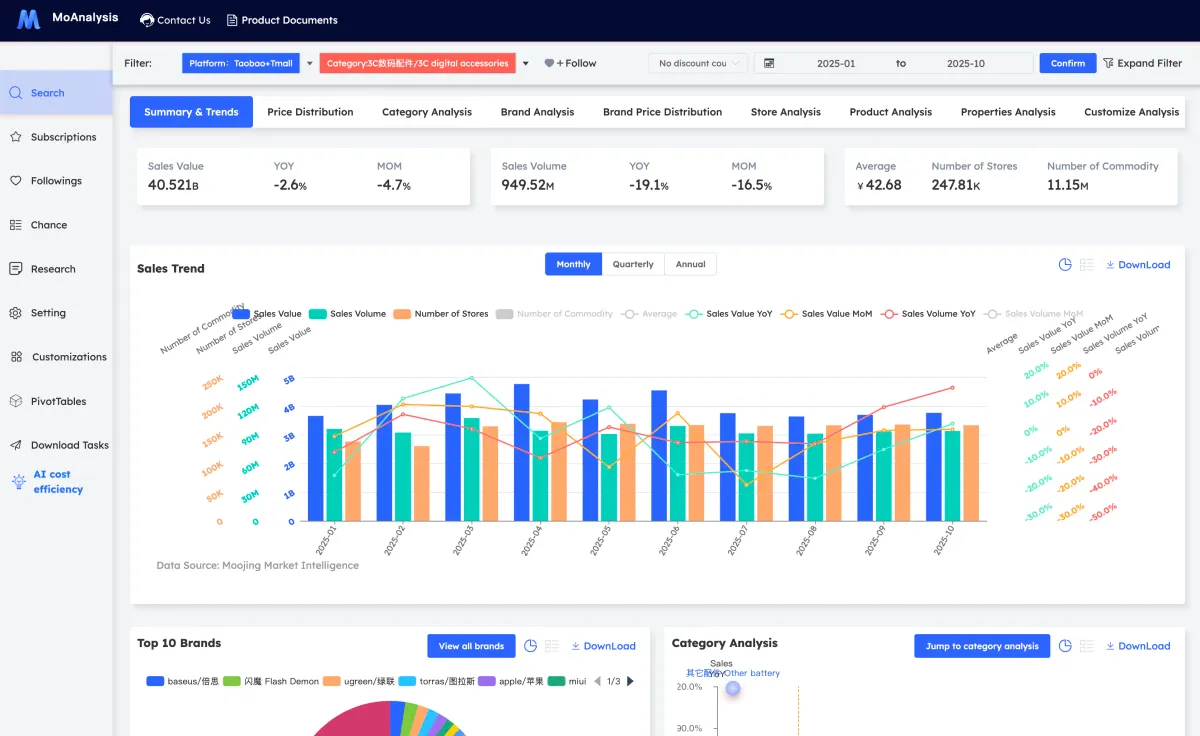

Request Custom CoverageSix-Layer Analysis Framework

From industry-wide trends to SKU-level attributes - comprehensive market intelligence at every level

- 1

Full Industry Sales

Track total addressable market and category dynamics

- 2

Own Brand Sales

Understand your brand's market position and performance

- 3

Competitive Brand Sales

Benchmark against competitors and identify threats

- 4

Store Sales

Optimize channel strategy and distributor performance

- 5

Product/SKU Sales

Granular insights at the individual product level

- 6

Attribute Sales

Understand what product features drive consumer demand

Strategic Layers (1-3)

- Layer 1: Full Industry Sales

- Monitor overall industry performance, seasonal patterns, and long-term growth trajectories

- Layer 2: Own Brand Sales

- Track your brand's market share percentage, channel performance, and historical trends

- Layer 3: Competitive Brand Sales

- Compare against top competitors, spot emerging threats, identify white space opportunities

Tactical Layers (4-6)

- Layer 4: Store Sales

- Compare flagship stores vs distributors, track which retail partners drive most sales

- Layer 5: Product/SKU Sales

- Monitor sales, reviews, and pricing for every individual product variant

- Layer 6: Attribute Sales

- Analyze sales by flavor, size, packaging format, ingredient type, and price tier

See Six-Layer Analysis in Action

From full industry trends down to SKU-level attribute insights. See how MoAnalysis helps you identify market opportunities across 400,000+ brands in 20+ countries.

Real-World Application Scenarios

From strategic planning to operational execution - see how leading brands use MoAnalysis

- Analyze total addressable market size

- Spot fast-growing niches (e.g., plant-based protein)

- Understand market concentration dynamics

Example: A snack brand discovered 'functional snacks' grew 45% YoY, launching a protein bar line that captured 8% market share in year one.

- Monitor top 10 competitors' monthly sales velocity

- Identify new competitor SKUs within weeks

- Track pricing strategy changes

Example: A beverage brand detected a competitor's zero-sugar line gaining 12% market share in 3 months, accelerating their own launch by 6 months.

- Compare product attributes against top-sellers

- Identify optimal price points

- Track promotional effectiveness

Example: A cosmetics brand discovered 300ml bottles outsold 150ml bottles 3:1 despite only 20% price premium, shifting production and increasing revenue 18%.

- Measure first 30/60/90 day sales against projections

- Combine with MoListening for customer feedback

- Compare to similar launches

Example: A baby food brand detected slower-than-expected velocity in week 2, pivoting to influencer marketing that tripled sales by month 3.

- Compare category size across 20+ countries

- Identify dominant players and pricing norms

- Analyze growth rates by market

Example: A Chinese tea brand chose Indonesia over Thailand due to 3x larger market size and 40% less competition, achieving profitability in year one.

- Analyze sales of similar products

- Validate demand before development

- Study analogous products in adjacent categories

Example: An investment firm validated a target's $50M market claim, discovering actual market was only $12M, saving them from a $15M overpayment.

Why Choose Moojing Market Intelligence?

Enterprise-grade data infrastructure with unmatched reliability

Enterprise Infrastructure: Our data pipeline processes billions of SKU records monthly with 99.9% uptime. Built for scale, designed for accuracy, trusted by Fortune 500 brands.

Complete Your Market Intelligence

MoAnalysis shows you WHAT sells. Combine with these modules to understand WHY and WHEN.

Extract consumer pain points, identify product opportunities, and monitor brand reputation across e-commerce reviews and 10+ major social media platforms.

Explore MoListeningDetect high-growth concepts before they saturate. Track trends through complete product lifecycle (startup to exit). Boston Matrix visualization for strategic planning.

Explore MoTrendsPerfect for consulting firms, RMS providers, and investment banks. Get API access, white-label data exports, and custom data transformation via MoProcessing.

Explore Enterprise SolutionsEnterprise Teams: Need API access, custom data feeds, or white-label exports? Explore MoInsights+ and MoProcessing for consulting firms, RMS providers, and financial institutions.

Start Monitoring Competitive Sales

See how MoAnalysis helps you identify market opportunities and enhance brand market share.