MoConsult

FMCG consulting backed by 10 years of proprietary consumer data and proven frameworks. Leverage our China market depth plus 20+ international markets for cross-border insights and global market entry strategies.

The FMCG Innovation Challenge

Three critical questions that FMCG teams struggle with.

Most brands rely on gut feeling or expensive consumer panels that take 6 months to deliver results.

By the time data arrives, competitors have already launched similar products and the market window has closed.

The Cost of Delay:

Every month of hesitation gives competitors first-mover advantage and valuable market share.

Generic category reports from traditional research firms only show market averages, not untapped opportunities.

You need granular, SKU-level insights to identify emerging subcategories before they appear in mainstream reports.

What You Actually Need:

Real-time product-level data that reveals micro-trends and consumer demand shifts as they happen, not months later.

Quarterly sales reports show the results, but they don't explain the underlying drivers behind market share shifts.

Which specific SKUs are driving their growth? What product attributes resonate with target consumers? What pricing strategies are working?

The Missing Layer:

SKU-level competitive intelligence that connects consumer behavior, product attributes, and market performance in real-time.

How We Help

End-to-end FMCG consulting from concept to launch to review

Concept Innovation

Identify market hotspots and emerging trends for new product concepts backed by real consumer data.

What You Get:

- Market trend analysis across China + 20+ international markets

- Consumer demand excavation from 10M+ reviews and social media conversations

- White space opportunity identification with actionable growth projections

- Concept feasibility assessment with competitive positioning

Illustrative Example

A global snack brand asked: "Should we enter the plant-based protein snacks category in China?"

We analyzed 4 years of data from China's leading e-commerce platforms, identified a 127% growth subcategory ("plant protein + zero sugar + portable format"), and validated a $15M opportunity.

Result: Client launched Q3 2024, captured 8% category share in 6 months.

Data Source: Powered by MoTrends and MoListening

New Product Design Recommendations

Transform consumer feedback into actionable product design direction with data-driven insights.

What You Get:

- Consumer feedback synthesis from e-commerce reviews + social listening

- Pain point prioritization based on volume and sentiment analysis

- Feature preference analysis (which attributes drive purchase decisions)

- Packaging and positioning recommendations aligned with consumer expectations

Illustrative Example

A beverage brand knew"functional hydration" was trending but didn't know which specific benefits consumers valued most.

We analyzed 50,000+ reviews across major social media platforms and e-commerce reviews. Top pain point:"too much sugar in sports drinks." Top desired benefit:"electrolytes without artificial sweeteners."

Result: Client reformulated and sales increased 34% in 6 months.

Data Source: Analysis from MoListening's 10M+ consumer reviews and social sentiment data

Market Monitoring & Review

Continuous intelligence on industry trends, competitive landscape, and market performance.

What You Get:

- Market size and growth tracking with monthly updates

- Competitive dynamics analysis (who's gaining/losing share and why)

- Performance reviews (quarterly/annual) with strategic recommendations

- Early warning alerts for emerging competitive threats

Illustrative Example

A Top 30 China brand uses our quarterly market reviews to track 12 competitors across 8 categories.

In Q2 2024, we identified a competitor launching a"zero-sugar" variant 3 months before it showed up in panel data.

Result: Client fast-tracked their own zero-sugar launch and protected 4% market share.

Data Source: SKU-level data from MoAnalysis tracking 400,000+ brands across platforms

Ready to Identify Your Next Product Opportunity?

Schedule a consultation to discuss your specific strategic challenges and see how our frameworks can deliver actionable insights.

Request ConsultationProprietary Analysis Frameworks

Four proven methodologies backed by 10 years of FMCG data

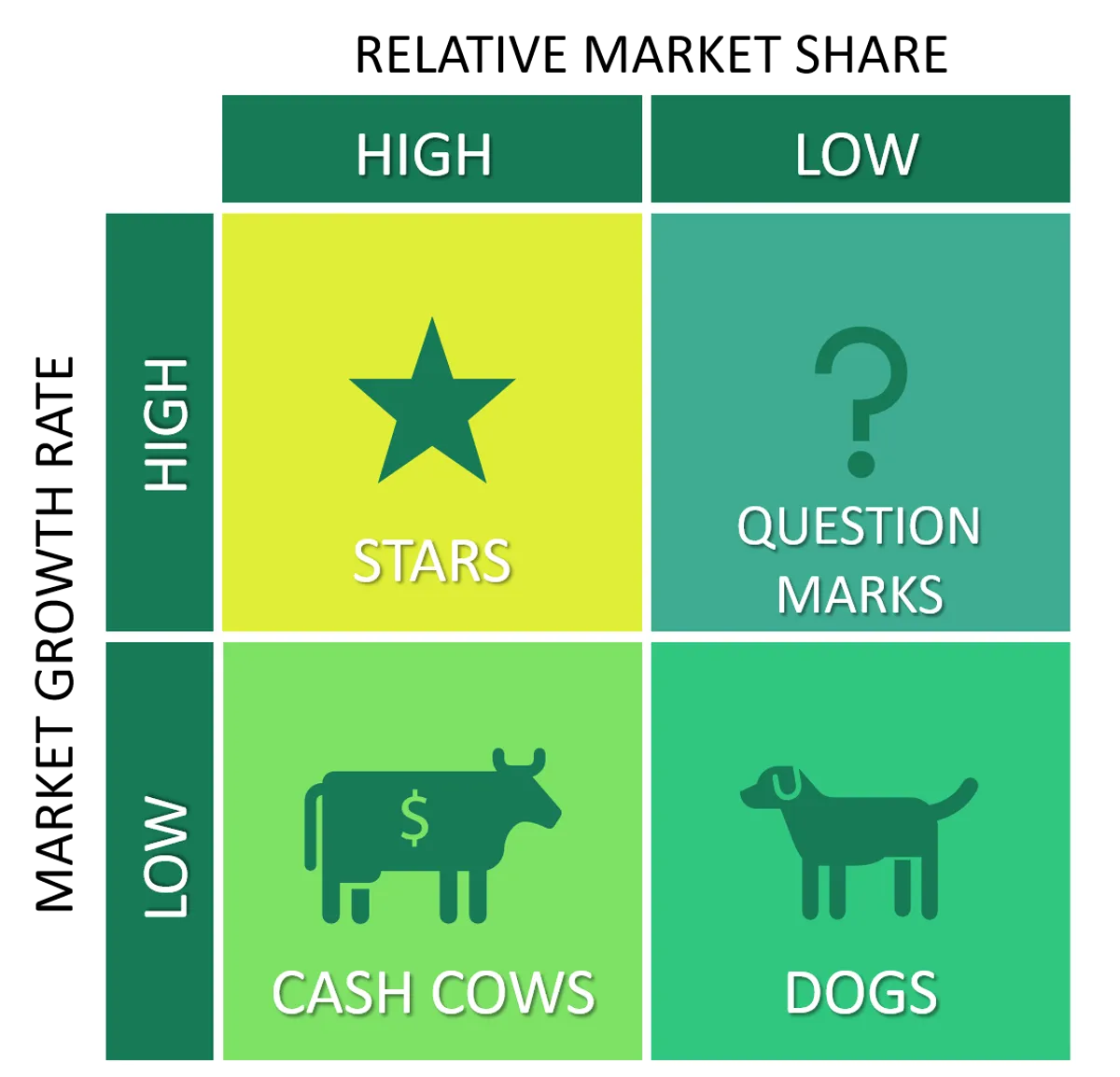

Boston Matrix Analysis

Identify Blue Ocean opportunities vs. Red Ocean saturated markets using real-time market data

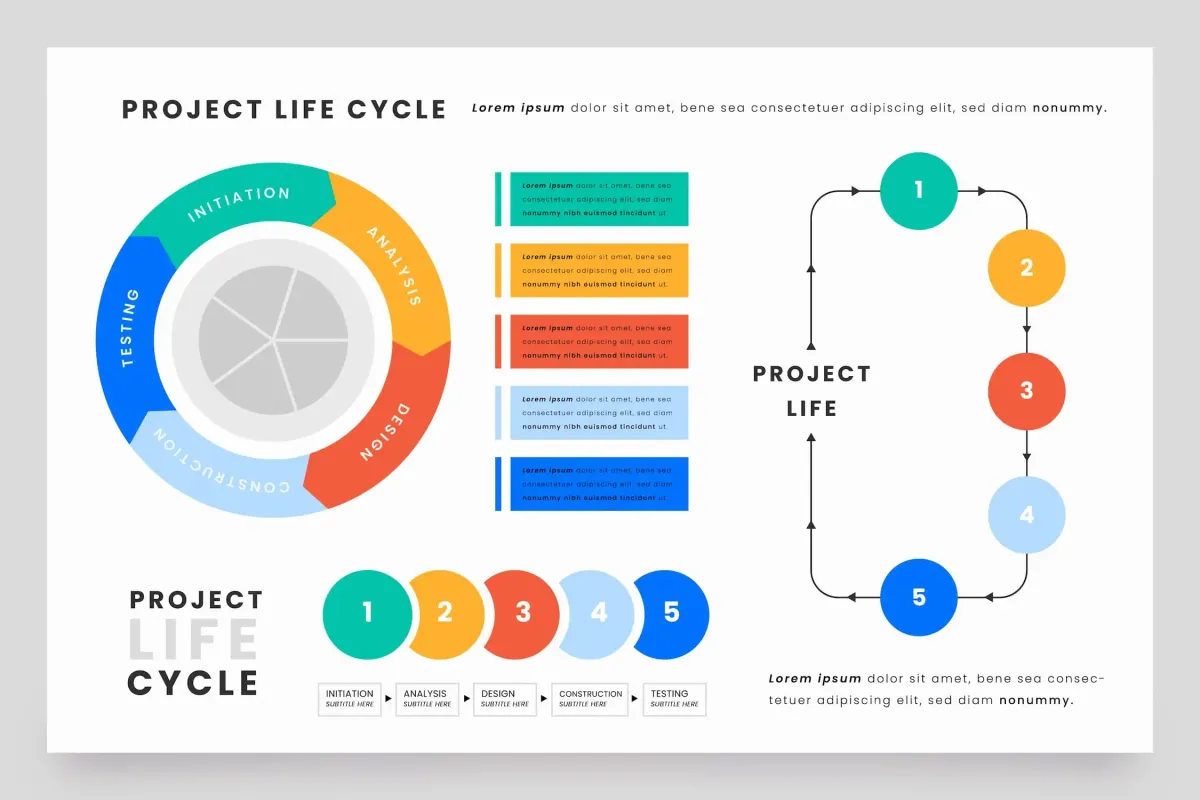

Product Lifecycle Framework

Know exactly when to enter, invest, or exit categories based on lifecycle stage (5 stages)

Product Innovation Four Forms

Balance your innovation pipeline across Reframe, Refresh, Break-in, and Break-out investment levels

Five-Dimensional Growth Analysis

Understand exactly where category growth comes from: channels, price, personas, scenarios, attributes

Boston Matrix Analysis

Identify Blue Ocean opportunities vs. Red Ocean saturated markets using real-time market data

How It Works:

Maps market concepts across growth potential (Y-axis) vs. competitive intensity (X-axis) using real sales data + consumer voice volume

Strategic Output:

- Blue Ocean: High growth, low competition → Invest here

- Red Ocean: Low growth, high competition → Avoid

- Growth Tracks: High-potential areas for focus

- Power Gaps: Areas needing innovation

Business Value:

Stop guessing where to compete - see exactly which subcategories offer the best ROI based on real market dynamics

Product Lifecycle Framework

Know exactly when to enter, invest, or exit categories based on lifecycle stage

5 Lifecycle Stages:

Startup → Growth → Stable → Decline → Exit

Strategic Recommendations:

- Startup: Monitor trends, test small batches

- Growth: Invest aggressively, scale fast before competitors

- Stable: Optimize costs, defend market share

- Decline: Harvest cash flow, prepare exit strategy

- Exit: Discontinue product, reallocate resources

Business Value:

Optimize your product portfolio by timing entry/exit decisions based on actual lifecycle data, not lagging indicators

Product Innovation Four Forms

Balance your innovation pipeline across investment levels with strategic resource allocation

4 Innovation Types:

- Reframe: Packaging updates (low cost, short cycle)

- Refresh: Flavor/format changes (moderate cost/cycle)

- Break-in: Component changes for niche needs (high cost/cycle)

- Break-out: Enter entirely new categories (very high cost, very long cycle)

Business Value:

Maintain a consistent innovation pipeline without over-committing to risky Break-out projects. Balance quick wins with long-term bets.

Recommended Portfolio Mix:

60% Reframe + Refresh (quick wins), 30% Break-in (strategic growth), 10% Break-out (future options)

Five-Dimensional Growth Analysis

Understand exactly WHERE category growth is coming from across multiple market dimensions

5 Growth Dimensions:

Channels • Price Segments • Consumer Personas • Usage Scenarios • Product Attributes

Strategic Questions Answered:

- Which channels show highest growth? (Social commerce vs. traditional e-commerce vs. emerging platforms)

- Which price points attract new entrants? (Premiumization trends)

- Which consumer segments are growing fastest? (Gen Z, urban professionals)

- Which usage occasions offer white space? (Post-workout, gifting)

- Which product attributes drive sales? (Organic, zero-sugar, portable)

Business Value:

See exactly where to focus your next product launch for maximum growth potential. Avoid generic"category is growing" insights.

Framework Integration

For teams requiring ongoing monitoring with these frameworks, MoInsights+ API access enables programmatic data retrieval. Need custom category definitions or unified product naming? MoProcessing handles complex data transformation.

Why MooJing Consulting?

Unique capabilities that set us apart from traditional consultants

Our Consulting Capabilities

- 10 years FMCG experience

- Decade-long specialization in fast-moving consumer goods markets

- China market expertise

- Deep local knowledge + 20+ international markets for cross-border insights

- Data-driven recommendations

- Every recommendation backed by SKU-level evidence, not generic research

- Custom market segmentation

- Tailored category definitions aligned with your business questions

- Proprietary data infrastructure

- 10+ years of historical data across 400K+ brands and platforms

- Real-time competitive intelligence

- Monthly updates vs. quarterly lagging panel data from traditional firms

MooJing vs. Alternatives

| Feature | Traditional | MooJing |

|---|---|---|

| FMCG Expertise | Generalist | 10+ years specialized |

| Data Granularity | Category aggregates | SKU-level |

| Historical Depth | 2-3 years | 10+ years |

| Update Frequency | Quarterly | Monthly |

| Frameworks | Generic templates | 4 proprietary |

| Consumer Voice | Surveys only | 10M+ reviews |

Value Statement:

We're the only FMCG consultancy that combines decade-long proprietary data infrastructure with specialized analytical frameworks. Traditional firms give you lagging aggregates. We give you actionable strategies backed by

What You Receive

Executive-ready strategic documents, not generic templates

Market Review Reports

Quarterly/annual performance analysis

Trend Discovery

Domestic + overseas opportunity identification

Product Sentiment Analysis

Consumer feedback synthesis

Competitive Intelligence Updates

Real-time monitoring alerts

Market Entry Strategy Analysis

New market expansion playbooks

Category Deep Dives

Comprehensive market research

Brand Health Assessments

Performance tracking dashboards

Innovation Pipeline Analysis

Concept validation reports

Format Note:

Executive-ready strategic documents combining proprietary data with expert analysis. Not generic templates - every report is customized to your specific business questions.

Who Benefits Most from MoConsult?

Ideal client profiles for FMCG consulting services

- Expert validation of concepts

- Consumer-driven innovation insights

- Competitive differentiation strategies

- Strategic guidance for market entry

- Localization recommendations

- Competitive dynamics understanding

- Executive-level market intelligence

- Strategic planning support

- Quarterly business reviews

- Consumer-driven innovation insights

- Feature prioritization

- Product roadmap validation

Complete Enterprise Solution

MoConsult works best when combined with other MoEnterprise services

Ready to Stop Guessing and Start Knowing?

Book a consultation to discuss your FMCG strategy challenges. We'll show you how our proprietary data and frameworks can answer your hardest questions.