Sparkling Growth: Insights into Japan's Booming Skincare Market on Amazon

By Industry Research Team

Dive into Japan’s vibrant skincare market on Amazon, driven by discerning consumers who prioritize quality and natural ingredients. This burgeoning sector presents opportunities and challenges for international brands seeking to establish a foothold, exemplified by the successful forays of brands like Perfect Diary from China.

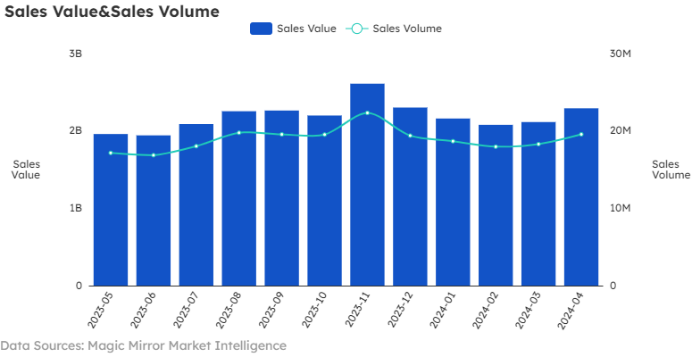

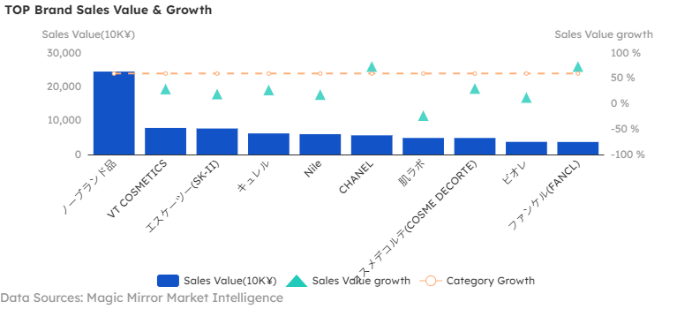

According to Moojing Oversea data, the beauty and skincare market on Amazon Japan achieved sales exceeding USD 3.17 billion over the past year, marking nearly a 60% year-over-year growth. Skincare alone reached USD 1.1 billion in sales, with a 57% increase, capturing over 30% of the market share.

Research indicates Japanese skincare consumers are relatively young, highly educated, and affluent, demanding high quality and showing strong brand loyalty with high repurchase rates.

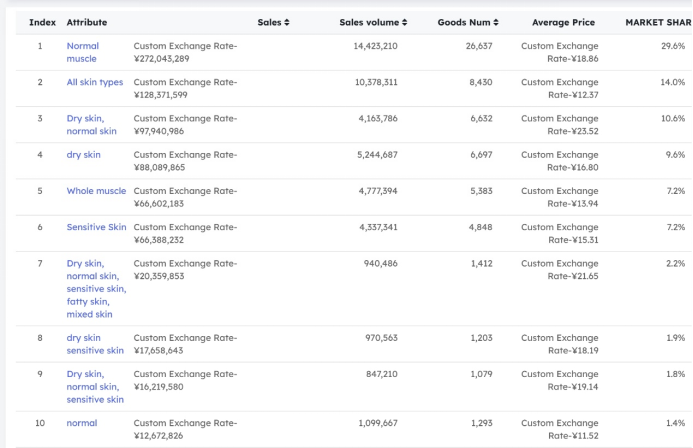

In terms of skincare preferences, products catering to “normal skin,” “all skin types,” and “dry skin” are most popular.

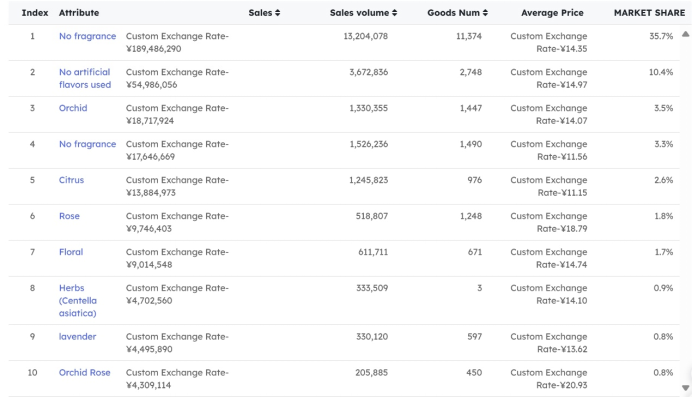

Japanese consumers prioritize natural ingredients and fragrance-free products hold nearly 50% of the market share.

Chinese beauty and skincare brands have been expanding into Japan in recent years, with significant growth noted. According to the Japan Cosmetic Imports Association, imports of Chinese cosmetics increased by almost 44% in 2022, totaling USD 70 million and ranking third in imports. Brands like Perfect Diary, Florasis, Into You, and Colorkey have embarked on successful journeys into the Japanese market.

Japanese consumers exhibit high brand loyalty and openness to new brands, with substantial repurchase rates once converted. For Chinese beauty brands entering Japan, establishing a foothold and cultivating a core customer base requires significant time and effort to resonate with local consumers.