Spice of Life: Indonesia's Turmeric Craze & Philippines' Gummy Boom

By Industry Research Team

Southeast Asian countries have experienced sustained high GDP growth, signaling enormous opportunities in the region’s health product market. To stand out in this market, health supplement brands should thoroughly research local market demands and make early strategic moves.

Indonesia: Turmeric Herbal Supplements Take Center Stage

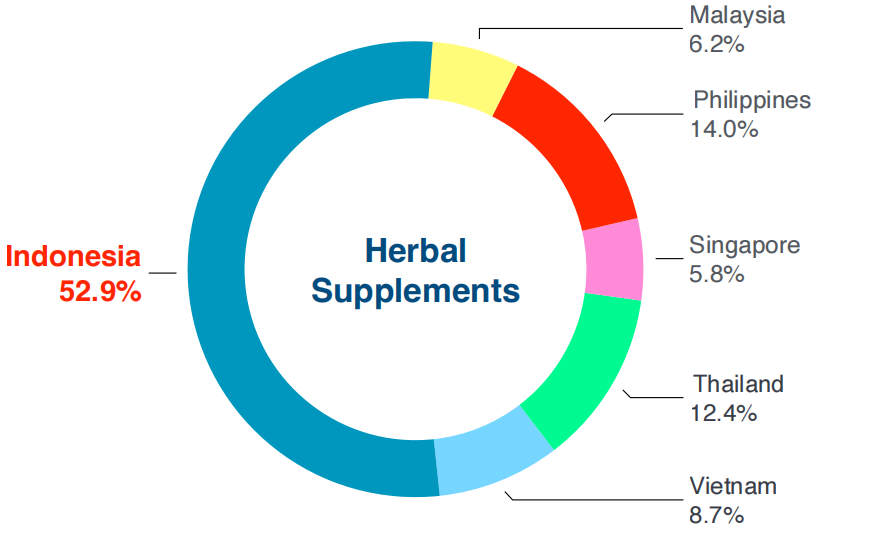

According to Moojing Group, compared to other Southeast Asian countries, the Indonesian market has a particular fondness for herbal supplement products, capturing a whopping 52.9% share of the overall market.

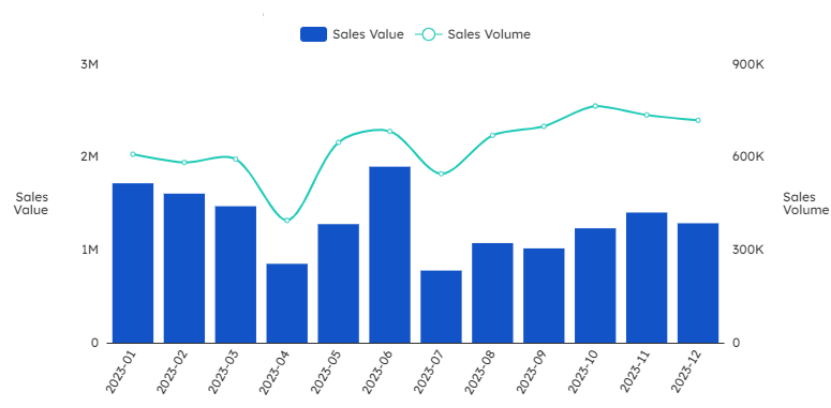

Moojing Oversea data reveals that herbal supplements in Indonesia generated sales of USD 17.44 million in 2023, marking a staggering 268% year-on-year increase and making it the fastest-growing subcategory in the Indonesian health product market.

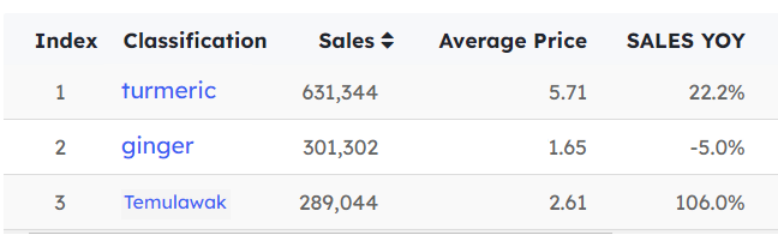

Consuming traditional beverages made with spices like ginger, turmeric, and temrawak (Javanese ginger) is an integral part of Indonesian societal culture. Local consumers widely believe that herbal spice ingredients are natural and have a long history, resulting in fewer side effects compared to health supplements containing chemical ingredients. Therefore, health supplements and herbal supplements featuring these traditional herbal spice ingredients have become mainstream in the local market.

Moojing Oversea indicates that turmeric products are the top-selling herbal supplements in Indonesia, commanding high unit prices with fewer product offerings, thus demanding significant attention from related brands.

Philippines: Focus on Gummy Formulation Health Supplements

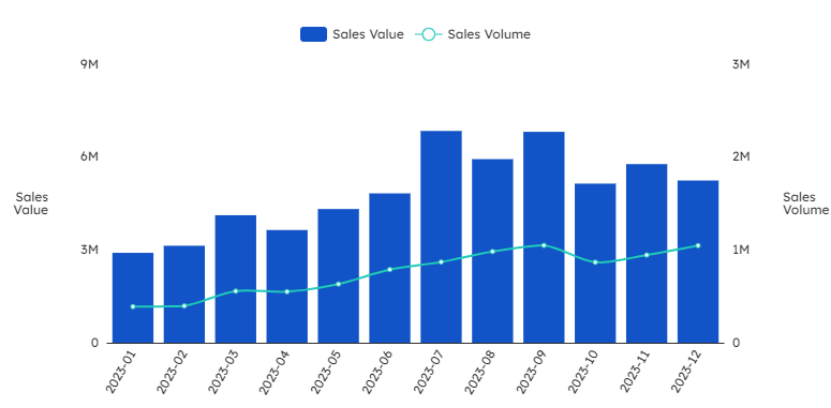

Online sales of health products in the Philippines primarily concentrate on the Lazada platform, surpassing USD 124.32 million in annual sales with an impressive 115% year-on-year growth.

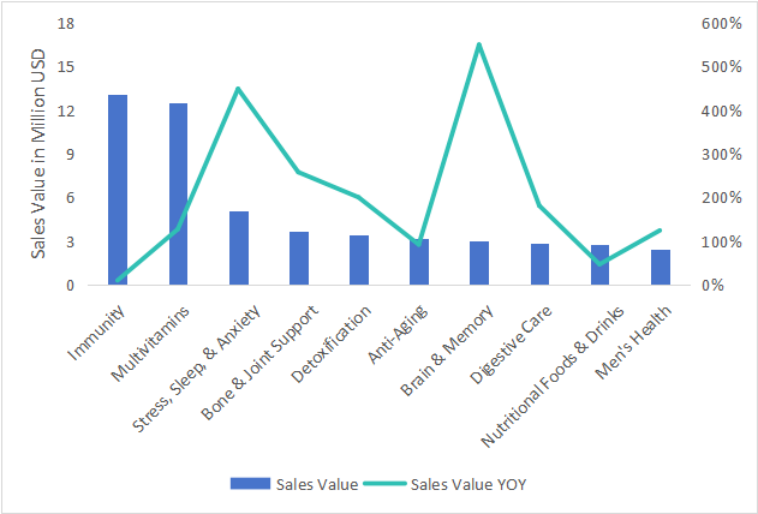

According to Moojing Oversea, the health nutrition category holds half of the Philippine health product market, with nearly 100% growth over the past year. Among these, immune and vitamin-related categories dominate the health nutrition segment with a 44% share, while the third-ranked sleep-anxiety-related category witnessed a staggering 500% growth in 2023.

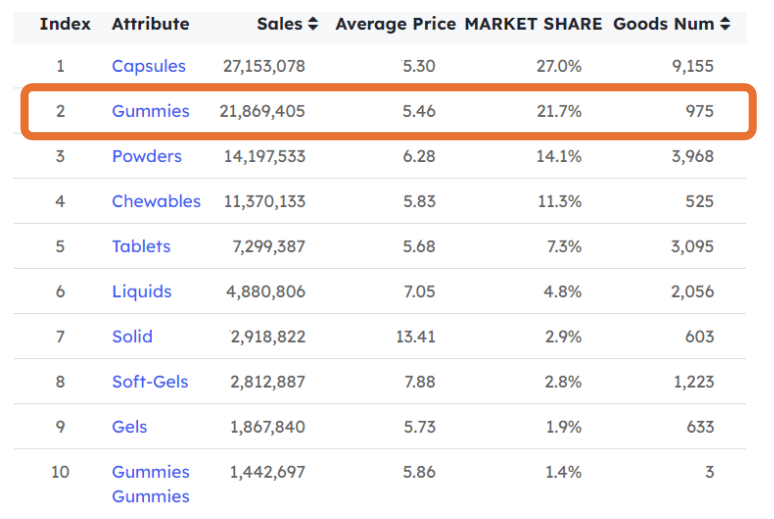

In terms of supplement formulations, capsules, gummies, and powders are preferred by Filipino consumers. Of particular note is the gummy product segment, which recorded sales of USD 23.31 million in 2023 with fewer than 1000 products available. Brands in this segment should consider early market entry.

Summary

Over the past three years, there has been a significant increase in people’s focus on health issues, driving continuous growth in global health supplement consumption. The entire health and wellness industry has entered a phase of rapid development.