74 Million+ Voice Volume, How Can Outdoor Brands Break Through Using Social Media Information?

By Industry Research Team

Data Explanation

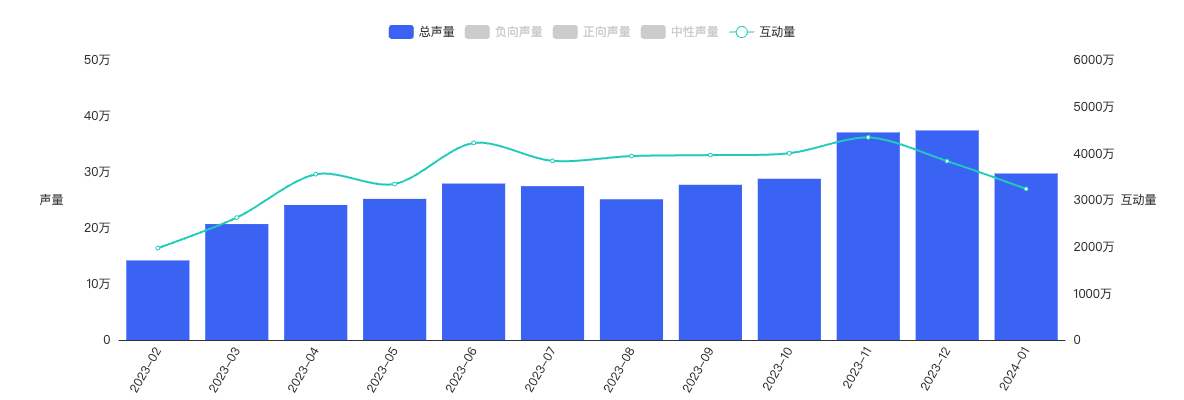

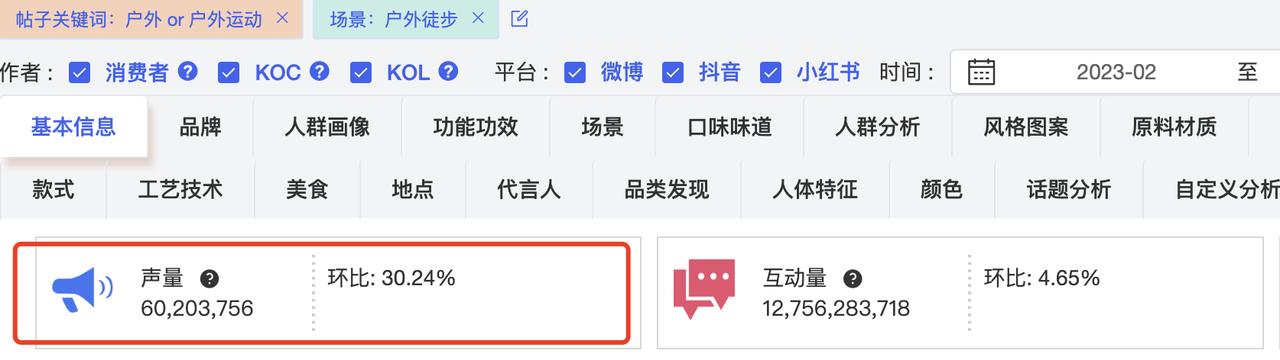

1.Voice Volume: Refers to the total number of posts, that is, the sum of the number of posts containing the current keyword.

2.Interaction Volume: Refers to the sum of likes, shares, and comments on corresponding posts, used to evaluate the popularity of the corresponding posts.

3.Filter Rules: Based on Moojing social listening, the posts on Xiaohongshu, Douyin, and Weibo platforms from February 2023 to January 2024 with the keywords “outdoor or outdoor sports”.

With spring upon us and temperatures warming, the enthusiasm for outdoor sports is also poised to surge.

In 2023, the online consumption of outdoor sports products grew rapidly, according to Moojing analysis + data, the market size of outdoor apparel on mainstream e-commerce platforms exceeded 30 billion yuan last year, with a growth rate of nearly 100%, far outstripping other apparel segments.

On the other hand, the voice volume of outdoor related topics on social platforms continues to rise, Moojing social listening shows that from February 2023 to January 2024, the number of posts related to outdoor or outdoor sports reached 74.57 million, a month-on-month increase of 38.33%. After the easing of the pandemic, people’s enthusiasm for participating in outdoor sports has significantly increased, with more consumers starting to pay attention to physical and mental health, engaging in various outdoor activities or sports to sweat out stress and release pressure.

Sociable, Seeking Pleasure, The Young Generation Falls in Love With Outdoor Sports

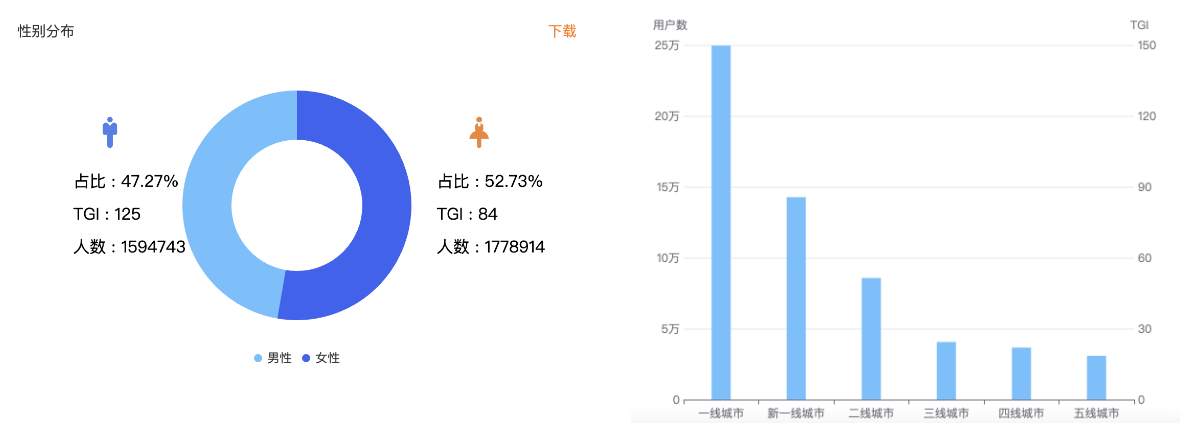

Outdoor sports are the home court for urban youth. According to Moojing social listening, the user profile of outdoor sports shows a balanced gender distribution, younger and more urban characteristics.

Specifically, the core audience is concentrated in economically developed regions such as first-tier and new first-tier cities, with women accounting for 52.7% slightly more than men, primarily under 35 years of age, comprising nearly 60%. It is worth noting that the group of people over 50 years old also holds a 14% share, with more elderly people joining the outdoor ranks.

A recent Tmall report, “2024 Spring and Summer Sports Outdoor Industry Trend Whitepaper,” indicates that the young group aged 18-29 accounts for nearly 40% of the consumption in Tmall’s spring and summer sports outdoor market, and young people prefer to socialize and gain knowledge during outdoor activities, emphasizing spiritual pursuit and social attributes.

For young people, going outdoors is not only about fitness, but more importantly, about enjoying the carefree experience of being “on the road” and embracing nature, as well as deepening their self-understanding in the process. Through their shares on social media, we find that for young people, outdoor sports sometimes resemble a journey of self-remodeling, matching the market trend where the young people place importance on spiritual consumption and self-fulfillment.

Leisure Outdoors Dominates, Parent-Child Scenarios Are Worth Engaging

The scenarios of outdoor sports are diverse and rich, covering a wide range of activity types and experiences. These activities not only occur in various natural environments such as mountains, forests, rivers, beaches, etc., but also involve different skills and physical demands.

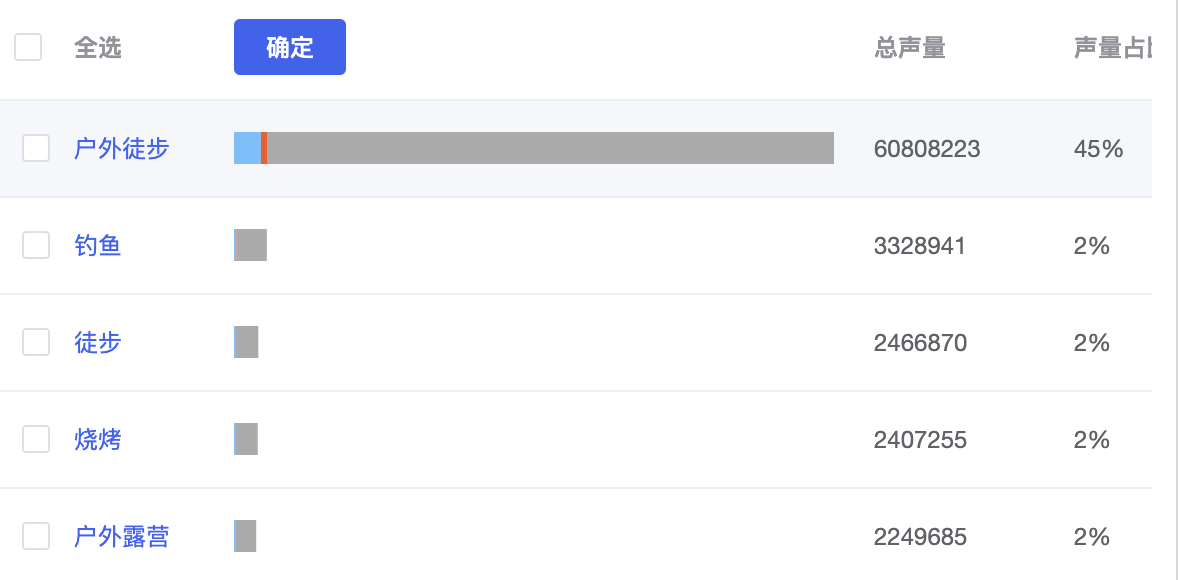

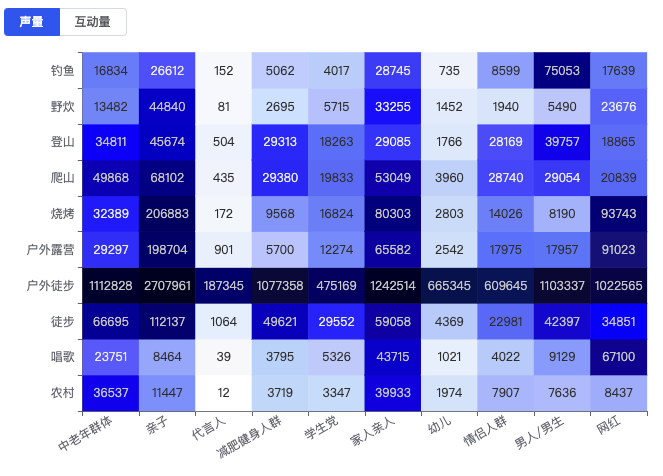

Some choose to traverse forests, streams, and snow mountains on foot to experience nature up close, while others enjoy the heart-rate spike during cycling. Moojing Social Listening data shows that social media content related to outdoor sports mainly involves common activities such as hiking, fishing, and camping.

According to Tmall’s latest user survey, the top 5 popular outdoor sports among the young group are hiking, mountain climbing, cycling, camping, and skiing.

Typically, outdoor sports can be roughly divided into hardcore and leisure categories, according to the difficulty level of participation and the physical demands on participants. Popular activities such as mountain climbing, skiing, rafting, rock climbing, etc., are among the former, with a higher threshold for participation; whereas hiking, camping, cycling, fishing, frisbee, etc., focus more on leisure and social aspects, with a lower threshold and a broader audience, very friendly to outdoor newcomers.

Taking the most popular hiking on social media as an example, Moojing Social Listening shows that from February 2023 to January 2024 the voice volume for content related to outdoor hiking reached 60.2 million, a month-on-month increase of 30.24%. Overall, discussions about outdoor sports on social media platforms are mainly focused on leisure activities.

Furthermore, through the cross-analysis of scene × audience, we can see that “parent-child” is also the main group in all outdoor activity scenes.

Hiking and camping are common family-unit outdoor activities. “China Economic News Network” reported that in 2020, the number of people camping in China reached 360 million times, with the age group concentrated among the younger generation and young families aged 21-45 taking the lead. Outdoor sports brands should fully consider the specific needs in this scenario during product design or marketing processes, to effectively address consumer pain points.

From Social Media Voice Volume to E-commerce Sales, Which Outdoor Brands Have Made a Breakthrough?

Outdoors is an activity that burns equipment; hardcore outdoor activities like skiing require professional equipment such as snowboards, ski suits, protective gear; and even leisure activities like hiking and camping require participants to purchase related clothing, footwear, tents, cooking gear, etc. Therefore, over the past three years, outdoor sports breaking out of the circle has driven the rapid development of the outdoor consumption industry.

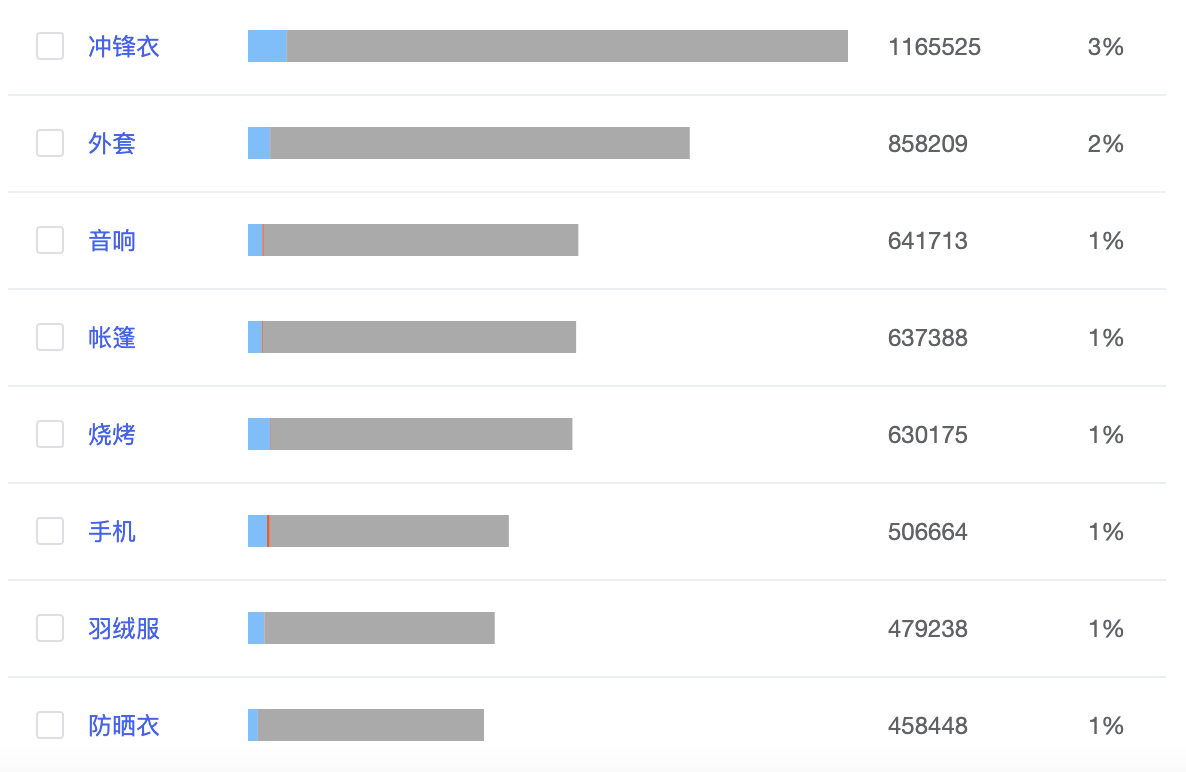

According to Moojing Social Listening’s “Category Discovery” dashboard, in the past year, items such as hardshell jackets, speakers, tents, down jackets, sun protection clothing, have been high-frequency in outdoor activity content.

The fermentation of content on social media often translates to e-commerce platforms and feeds back to online sales.

Taking “hardshell jackets” as an example, according to Moojing Analysis + Data, in the past rolling year, the market size of hardshell jackets on mainstream e-commerce platforms exceeded 7.5 billion yuan, with a year-on-year growth of 85.2%, with recent sales peaking during the Double 11 period.

How to effectively conduct content marketing or leverage trending events to transition product features on e-commerce platforms, thereby creating a hit product, is a topic that new consumer brands cannot avoid.

Currently, the online market for hardshell jackets is highly competitive, with Camel leading with 1.9 billion yuan in sales and a 25.4% market share over other domestic and international outdoor brands, Boshiwa ranked third, and these two brands also rank at the forefront in terms of discussion on social media platforms.

Camel, Boshiwa leveraged social media content marketing and note planting, integrated ideas about outdoor fashion, and strengthened brand mindshare with “cost-effectiveness”, “functionality”, “aesthetics”, eventually securing the top market shares with a year-on-year growth rate of 174.6% and 273.1%, respectively.

Summary

The Outdoor Market Is Entering A Shuffle Phase, with continuous news of brand store closures and startup failures appearing. In the context of intensified market competition, analyzing and understanding consumer needs through social media topics, uncovering potential marketing scenarios, and forming differentiated strategies will become key for brands to break through and win.

Every day, hundreds of millions of netizens interact and voice opinions on various social platforms. Moojing Social Listening is based on massive social media data, building modules such as audience analysis, user profiles, scenarios, categories, brands, etc., empowering brands to observe hot trends and providing efficient solutions for brand insights into target users and discovering new market demands.

For more social media data on “Outdoor Sports”, please subscribe to Moojing Social Listening product. We will also regularly deconstruct hot topics and products on social media for everyone.

The above social media insights are based on research from the Moojing Social Listening platform. By analyzing posts on mainstream social media platforms like Weibo, Douyin, and Xiaohongshu, brands can not only promptly discover consumer hotspots but also, in other more general scenarios, such as:

-

Insight into the Needs, Pain Points, and Usage Scenarios of the Product’s Target Audience

-

Sorting Through Consumer Experience and Satisfaction to Timely Improve Product Quality

-

Analysis of Competing Products and Heat Monitoring to Uncover the Reasons Behind Bestsellers

-

Viewing Market Heat Trends and Emerging Demands, Empowering Product Innovation and Development Direction

All these scenarios can actually be addressed through the Moojing Social Listening platform. In the future, we also hope to discuss and create more application scenarios together with brands during the use of our platform, helping brands to understand user needs and explore consumer scenarios through social media hotspots, to achieve product innovation and complete brand growth!

If you want to know more about consumer hotspots and gain deeper insights into consumers, welcome to scan the QR code and contact us!