Xidesheng And Trek Surge More Than 200%, Is The Road Bike Market Facing Continuous Opportunities?

By Industry Research Team

Key Points Of The Article:

1.The construction of hardware facilities such as urban greenways has provided conditions for the popularity of road bikes, and the increasing number of road cycling events held domestically has further promoted the popularity of road bikes.

2.Road bike brands have always been diverse, with Giant, Decathlon, Trek, and others being among the leaders; however, as consumers increasingly seek value for money, Xidesheng, as a domestic brand, has also become the choice of a significant portion of riders.

3.In the future, road bicycles may trend towards being lighter, smarter, and electrified.

Cycling is becoming a trendy sport that young people love.

As a healthy and natural form of exercise, cycling allows participants to fully enjoy the pleasure of exercising, and in the process of cycling, participants can get close to nature and strengthen their willpower by overcoming the difficulties encountered along the way.

The scenarios in which people use bicycles are constantly changing, evolving from commuting to work to racing and competing. The entry of the world’s three major cycling races – Tour de France, Giro d’Italia, and Vuelta a España – into China has further strengthened the racing attributes of bicycles and ignited the road bike sub-category.

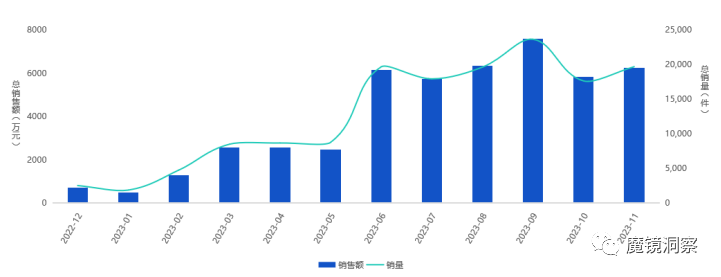

Road bikes originated in Europe and were originally designed for racing. According to Moojing Market Intelligence data, from December 2022 to November 2023, the sales volume of road bikes on mainstream e-commerce platforms reached 1.73 billion yuan, with a year-on-year increase of 158.9%. The average price was 2,573.90 yuan, indicating a relatively high threshold for consumers.

Why Are Road Bikes In Demand?

Firstly, the outdoor boom has driven the cycling craze, with cycling tours around cities being increasingly accepted by many, becoming an excellent entertainment choice for people’s weekends. To some extent, this has driven the sales boom of road bikes online and offline, and due to the surging demand in recent years, there has been a shortage of road bike components in the market, sometimes leading to situations where bikes are hard to come by.

According to data from China Business Journal, in recent years, the revenue of the high-end bicycle market has increased by 20%, with bicycles priced above a thousand yuan seeing an increase of over 13%.

Compared to mountain bikes, road bikes are more lightweight in terms of components, with road bike frames being lighter, tires narrower, gear systems simpler, and average speeds faster, making them suitable for city riding or relatively flat surfaces, thus offering more diverse scenarios including everyday commuting.

At the same time, concepts such as green transportation are supported by government policies, with the government building more and more greenways around cities that are suitable for road cycling, including some premium cycling routes, providing the infrastructure for cycling. For example, Chengdu launched 11 Tianfu Greenway cycling routes, Beijing has the “City Wind Wheel” cycling routes, Guangzhou’s Zengcheng District offers the “Encountering Zengcheng, Endless Cycling Joy” greenway, and Wuhan has the East Lake Greenway cycling route.

Additionally, more and more road cycling events are being held domestically, such as the Tour of Qinghai Lake International Road Cycling Race, China Road Cycling League, and Tour of China International Road Cycling Event, which typically occur annually in multiple cities, attracting many people interested in road cycling to participate. To some extent, these events popularize road cycling and broaden its audience.

In recent years, the lifestyle concepts of young people have been changing, and their understanding of road bikes has deepened. Many young people choose to go for night rides after a day’s work or have planned long-distance cycling trips on weekends. Some even say, “I’ve learned the joy of sports while cycling.”

Others jokingly advise, “Don’t try cycling lightly, or you will fall in love with it as hopelessly as I did.”

It can be said that road bikes provide urban dwellers with a unique adventure experience, and cycling represents not just a social status but also reflects an individual’s lifestyle interests. The popularity of road bikes is the result of a combination of hardware conditions and enhanced consumer awareness.

Changes In The Road Bike Market Landscape

Road bike brands have always been a diverse playing field, with Giant, Decathlon, Trek, and others leading, and now, Xidesheng as a domestic brand has also become the choice for a large part of the rider community.

According to Moojing Market Intelligence data, from December 2022 to November 2023, on mainstream e-commerce platforms, the main price ranges for road bike sales were concentrated between 0-2594 yuan, and 2595-5188 yuan, indicating that consumers pay considerable attention to cost-effectiveness when purchasing road bikes, with domestically branded bikes that are relatively moderate in price also favored to some extent by consumers.

Xidesheng is one of the largest bicycle manufacturers in China, with an annual production of about 10 million bikes. The brand’s advantage lies in that its design, production, and assembly can all be conducted domestically, thus effectively controlling costs, which makes its products relatively cost-effective. According to Moojing Market Intelligence data, from December 2022 to November 2023, on mainstream e-commerce platforms, the sales volume of Xidesheng’s road bikes was about 480 million yuan, with a sales quantity of approximately 153,000 units.

One of its more popular models is the entry-level CR200 road bike, which features a lightweight aluminum alloy frame that is light and has good rigidity, with a net weight of around 15kg and a variety of color options. In terms of gear shifting, the model is equipped with the Blueprint 14-speed shifter system, which facilitates precise gear changes, providing cyclists with a better riding experience.

As one of the most important components of a bicycle, the gear shifter determines the bike’s gear shifting performance. In the past, road bikes mostly used gear shifters from overseas brands, but now, with the increase in domestic brand’s R&D capabilities and consumer acceptance, domestic road bikes will also use domestically produced gear shifters to meet different market requirements.

According to Moojing Market Intelligence, from December 2022 to November 2023, the sales volume of the CR200 road bike model on mainstream e-commerce platforms reached 21.744 million yuan, with an average product price of about 2198 yuan.

Another popular model from Xidesheng is the new 2023 AD350 aerodynamic road bike, equipped with Xidesheng’s X6 alloy frame, which is reputedly lighter and contributes to improved speed. Additionally, this model utilizes a one-piece welding process for the body, which not only results in smoother and flatter joints but also ensures greater rigidity of the overall frame.

Although known for more affordable road bike models, Xidesheng also offers relatively high-end models, such as the RS450 aerodynamic road bike, priced at around 7998 yuan. Compared to more affordable products, this series features imported Shimano Tiagra series gear lever, front derailleur, and rear derailleur, resulting in better gear shifting details and more precise steering, purportedly offering consumers a superior riding experience. The brand’s launch of high-end models aims to establish its presence in different price segments to meet the needs of various consumers.

Another brand ranking well on mainstream e-commerce platforms is Trek, which originates from Wisconsin, USA. The brand holds the exclusive OCLV carbon fiber technology patent. According to Moojing Market Intelligence, the brand’s road bike sales from December 2022 to November 2023 on mainstream e-commerce platforms amounted to 72.861 million yuan, with a year-on-year growth of 290.1%, and an average product price of about 5954 yuan.

Trek sponsors many athletes in both the United States and China, such as Lance Armstrong from the US and Li Fuyu from China, and furthermore, Trek also promotes its brand through sponsoring the US Discovery Cycling Team, Chinese Mountain Bike Festival, and other events.

Trek’s road bikes are mainly divided into three models: the Emonda, Madone, and Domane, with the SLR models using high-end OCLV 800 carbon fiber and the SL models using mid-tier OCLV 500 carbon fiber.

Taking Trek’s DOMANE AL2 DISC as an example, its transmission system uses the Shimano shifting system, and the whole bike weighs only between 5.6kg and 10.6kg. It is said that consumers can use this road bike on both smooth pavements and cobblestone roads. The frame is specifically modified for long-distance riding, with internal cable routing, and it is designed to be more enduring than short-distance road bikes, supporting riders for extended periods of cycling. At the same time, this model uses Shimano’s 2X8 transmission system, which is claimed to allow the road bike to proceed normally in rainy weather and when climbing hills, to some extent increasing the product’s application scenarios.

According to Moojing Market Intelligence + Data, the average price of this product is about 7,380 yuan, with sales of 3.424 million yuan on mainstream e-commerce platforms.

Trek’s Domane Endurance Road Bikes Have a Certain Influence in International Competitions, with riders including Longe Beruni recently achieving commendable results in Paris road cycling events on Trek’s Domane bikes, which reflects the professionalism of Trek’s road bikes to a certain degree.

Trek also has road bikes specifically designed for racing, such as the Trek Emonda SL 5 series, priced at around 20,000 yuan. This model not only features DOMANE’s proprietary OCLV carbon fiber frame for a significant balance between strength and stiffness but also is designed to absorb vibrations during travel. Its aerodynamic tube design helps reduce drag, reportedly allowing consumers to ride more effortlessly on flat roads or climb hills more briskly. According to Moojing Market Intelligence+, as a competition-level bike, Trek’s Emonda SL 5 had sales of approximately 2.289 million yuan on mainstream e-commerce platforms from December 2022 to November 2023.

The People Behind Road Bikes

According to Moojing Social Listening data, from December 2022 to November 2023, 42.47% of the posters on major media platforms discussing road bikes were male, and 57.53% were female.

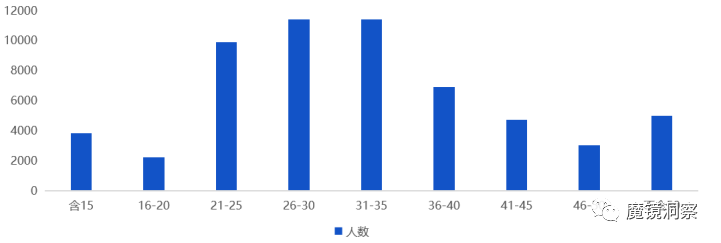

Age-wise, younger individuals are more interested in the sport of road biking, with the 21 to 35 age group having the largest proportion of posters about road bikes. It’s evident that as outdoor activities continue to develop, road biking is becoming a form of social currency among young people, with more and more of them becoming interested in road biking.

In terms of urban level distribution, posters from first-tier cities account for the largest proportion of road bike posters, which is related to the more developed economies of these cities, higher consumption of road bikes, and better-equipped facilities like urban greenways.

Future Development Trends

As consumers’ demands for road bike speed continue to increase, the technology in road bikes is evolving, and carbon fiber technology is improving. Brands will further make their road bike products lighter to increase speed, and light-weighting may become a trend in the future development of road bikes.

Thanks to advancements in battery technology, it has become possible to equip road bicycles with electric assist systems. Many brands have seized this opportunity to introduce electric road bikes. Although electric road bikes are not yet mainstream, they are a good alternative for those who are not adept at cycling.

At the same time, road bikes are becoming more intelligent. Many road bike manufacturers are choosing to collaborate with companies such as Apple and Huawei to connect road bikes to the Internet of Things, enhancing their interactivity and allowing consumers to better monitor the operation of their road bikes.

Summary

Improvements in hardware conditions, the popularization of cycling concepts, and a passion for the outdoors have jointly driven the development of the road bike market. As road bikes become increasingly popular with consumers, international brands are no longer the only choice. Local brands have also gained a voice in this market by innovating technologies and offering products that are more suitable for local consumers to attract more road bike enthusiasts.

Consumers have also become more rational than before and are not fixated on expensive equipment. To strike gold in the road bike industry, the quality of the product is of utmost importance. Road bike brands need to pinpoint their positioning and further strengthen product innovation to win consumer favor.