Sugar Friends Full Satiate Explodes With Tens Of Millions In Sales, What Are The New Trends In Diabetic Staples?

By Industry Research Team

Key Points of The Article:

-

Over 90% of the diabetic population in China are type 2 diabetes patients, with causes largely related to diet. Adopting a low-carb diet is a relatively feasible method of control, which also means there is a larger potential market for diabetic foods in China. The target demographic and their consumption habits for diabetic food are constantly evolving, with younger people becoming a higher risk group for diabetes. At the same time, the taste and functional demands for diabetic food are increasing.

-

Brands like Sugar Friends Full Satiate and Slow Sugar Home, specifically catered to diabetics, are reinventing diabetic foods to make them tastier while maintaining their blood sugar control functions.

-

In terms of future development directions, diabetic food brands like Sugar Friends Full Satiate are choosing to target niche audiences to further provide solutions for diabetics.

Sugar, initially associated with sweetness and fragrance, can increase the risk of diabetes when consumed in excess.

According to epidemiological surveys, the total number of diabetics in China exceeds 140 million people, with a prevalence rate of 12.8%. China is the country with the highest number of diabetics globally, and the incidence shows a trend towards a younger demographic. The diabetic food market started fragmented but has now gradually developed proprietary brands and niches for diabetic diets.

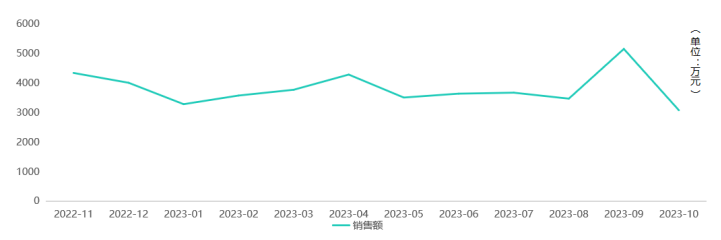

As per Moojing Market Intelligence data, from November 2022 to October 2023, on mainstream e-commerce platforms, the sales volume of foods related to the concept of diabetes was about 460 million yuan, and the number of brands entering this track reached over one thousand, including several brands such as Sugar Friends Full Satiate and Slow Sugar Home.

Low “Carb” Blood Sugar Control, The Explicit Need Of Diabetics

In recent years, the proportion of refined grains, high-fat, and high-oil foods in the Chinese diet has been increasing. Excessive intake of these foods can cause drastic fluctuations in blood glucose levels, affecting insulin secretion and ultimately increasing the probability of developing diabetes.

Unreasonable dietary structures have led to a continuously growing number of diabetics in China, with type 2 diabetes patients accounting for 90% of China’s diabetic population. Starting with the diet and adopting a low-carb approach is a feasible way of reducing insulin resistance and controlling type 2 diabetes.

Considering the number of type 2 diabetes patients and those in the prediabetic stage, the potential consumer base for diabetic foods in China is undoubtedly enormous.

Not only has the potential market size for diabetic foods increased, but the target audience has also been changing.

The high-risk group for diabetes is no longer just those over forty years old; younger people in their twenties and thirties have begun to suffer from the disease. According to epidemiological surveys, young people’s diabetes is generally more influenced by lifestyle factors.

First of all, being overweight has become a common issue among young people, and few can resist the temptations of milk tea and desserts. High stress and fast-paced life lead many youths to rely on foods heavy in oil and salt. Furthermore, staying up late and working overtime, which disturb insulin secretion, have become the norm in many young people’s lives, further exacerbating the risk of diabetes.

Genetic factors also increase the likelihood of young people developing diabetes. On one hand, family genes can affect the young, and on the other, subtle family dietary habits influence the incidence rate in the youth.

In addition, the consumption concept of the elderly with diabetes is changing, influenced by current economic development and the internet wave. Today’s elderly are more willing to spend to enhance their quality of life and are more open to accepting new things than before.

It is foreseeable that the demands for blood sugar control foods will continue to rise.

Firstly, there is the functional aspect of diabetic foods, where people are paying more attention to the product’s glucose-lowering effect, closely examining the ingredient list. They hope that consuming blood sugar control products can indeed effectively manage their glucose levels. To this end, they use glucose meters to test blood sugar levels before and after meals to observe the food’s impact on blood glucose.

At the same time, consumer expectations for the taste of diabetic foods continue to rise. The richness of modern foods has elevated people’s expectations for taste, making coarse and difficult-to-swallow sugar-reducing foods less popular with consumers.

Consumer Demand Upgrades, How Should Brands Respond?

In response to consumer needs, diabetic-related foods are also constantly evolving. Initially, diabetic-friendly foods on the market were quite basic, including staple coarse grains biscuits and xylitol pastries.

With continuous upgrades in the food industry’s supply chain, more innovative processes and more effective blood sugar control ingredients have been applied to diabetic foods.

The market has gradually welcomed food brands tailored for diabetics, such as Sugar Friends Full Satiate and Slow Sugar Home.

Sugar Friends Full Satiate positions itself as a professional diabetic food brand, with its first product being a blood sugar control bread, followed by a series of products specifically for diabetics. Through scientific research and development, the brand has revised staples like noodles and bread for diabetics, claiming that their products maintain a tastier flavor while having significantly lower carbohydrate content than the original, addressing the generally less palatable nature of diabetic-friendly foods.

According to Moojing Market Intelligence data, from November 2022 to October 2023, this brand’s sales volume on mainstream e-commerce platforms was 20.623 million yuan. In addition to traditional products like noodles and bread, the lineup also includes items traditionally considered unsuitable for diabetics, such as European-style buns, egg yolk shortcakes, coconut cakes, and cream-filled biscuits.

In terms of product taste, taking their cream-filled European bun as an example, it comes in flavors like dairy and chocolate, and the taste difference from regular European buns is not significant, aligning well with modern dietary habits. Many users have given feedback that the filling of this product is delicious and fragrant. This product has significant sales on mainstream e-commerce platforms, and according to Moojing Market Intelligence data, from November 2022 to October 2023, the sales volume of this product was about 4.81 million yuan, with a year-on-year growth rate of 3294.9%, showing a strong growth momentum.

The egg yolk shortcake is a new product from Sugar Friends Full Satiate this year, featuring low carbohydrates while maintaining taste. This product has a four-layer filling design; the first layer is low-carb premixed flour crust, supposedly using the brand’s exclusive low-carb premix instead of wheat flour. The second layer is crispy pork floss without added sugar or starch, and the third and fourth layers are sesame paste and salted egg yolk, further enhancing the product’s flavor. Since its launch in April 2023, this product has made an approximate sales volume of 584,000 yuan on mainstream e-commerce platforms.

The healthy sales of these products also illustrate to some extent that products in line with consumer needs are easier to gain acceptance and increase the purchase rate than trying to change consumers’ eating habits or spend a lot of time and money on educating customers.

Most diabetics in China are type 2, which is closely related to diet, with most people’s diets centered around refined grains. Under these circumstances, it is unlikely that consumers will switch to a low-carb diet based on tubers and cereal grains in a short time. Considering the high work pressure of many people today and the lack of time to plan meals daily, forcefully changing consumers’ dietary habits would cost even more.

This is why diabetic food brands choose to redo the high-carb products on the market, improving their taste while ensuring their functionality to reduce the conversion cost for diabetics and increase the chances of brands and their products being accepted.

So, How Do New Products Targeting Diabetics Ensure Their Functionality?

Many brands in the market opt to use sugar substitutes such as erythritol to reduce the sugar content in their products, while new brands like Tangyou Baobao also add ingredients such as mulberry leaf extracts, pure turmeric, and oat beta-glucan.

Mulberry leaf extract can block the absorption of carbohydrates to some extent, claimed to inhibit sugar metabolism enzymes, delaying polysaccharide breakdown, and is also said to have a certain effect in promoting insulin secretion and improving insulin resistance.

Another ingredient, turmeric, has recently gained popularity as a superfood and was once made popular internationally by being a “supermodel’s choice”, reputed to improve skin inflammation and lower blood sugar and lipids.

Oat beta-glucan, a polysaccharide component widely found in the oat endosperm, is also widely recognized to lower blood lipids and serum cholesterol, purportedly by reducing the small intestine’s absorption of carbohydrates, thus lowering blood sugar concentration.

Therefore, foods specially researched for diabetics can, under the combined effect of these ingredients, control blood sugar to a certain extent and prevent drastic fluctuations.

To further increase the credibility of its products in reducing blood sugar, Tangyou Baobao collaborates with large tertiary hospitals to conduct clinical trials on its products, with each round of experiments estimated to take about two years. The hospital has validated that its products are capable of suppressing blood sugar increases. This has also been verified by users of its products, who generally find their blood sugar fluctuations stay within the normal range after consuming Tangyou Baobao’s products.

How Will The Future Be Decided?

Brands in the market are exploring future directions, and although diabetes has a long history as a chronic disease, the process of brands developing food targeting diabetics for niche markets is not very long.

Brands also face choices, whether to continue targeting niche groups, delve deeper into consumption scenarios, increase diabetics’ trust in their products thereby increasing the repurchase rate, or to target the trendy dieting and calorie-control crowd, developing major products to tap into a broader market?

Tangyou Baobao’s choice is to continue delving into niche groups, which is evident from the naming of its products; its “Daily Noodles” have been renamed “Diabetic Noodles”, further increasing the association with diabetes through the product naming and aiming to deepen its professional image in consumers’ minds.

Also, recent scientific research has demonstrated that although type 2 diabetes has not yet been completely cured, it can be reversed to a certain extent, meaning that diabetics can reduce the frequency of medication through diet control and other methods.

Based on this, Tangyou Baobao has established the Tangyi Bangbang Internet Hospital. According to Tangyou Baobao, the goal of Tangyi Bangbang is to help reverse symptoms for 5 million type 2 diabetes patients by 2035. The hospital plans to provide a full set of solutions for type 2 diabetes patients by combining a low-carbohydrate diet with visual efficiency tools and nutrition health managers.

By attempting to control food intake and providing corresponding schemes to alleviate diabetic symptoms and reduce medication, a simple and operable health management system is being established for patients. This is a further step in delving deeper into the demands of diabetic patients, and an evolution of the business model for diabetic food brands.

Conclusion

As a chronic disease, the cultivation of the diabetes market requires a prolonged process, and not only must patients be patient when facing the disease, but diabetes brands also need to adopt long-termism. Long-term thinking is needed in everything from product development to directional choices.

Diabetic foods are of great importance to diabetics, and as their market potential is verified, it is believed that more brands will enter this track in the future, bringing consumers more healthy and delicious products.