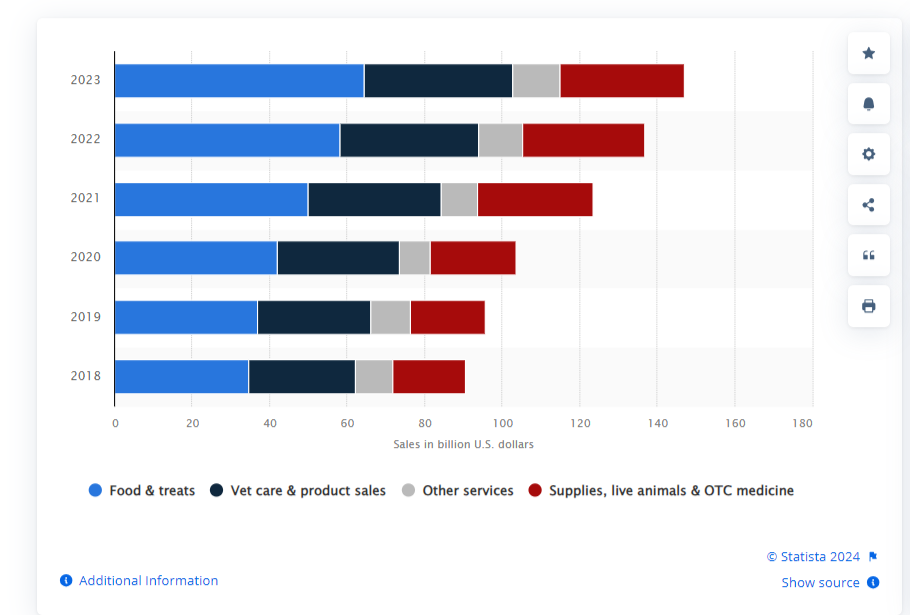

In recent years, the global pet industry has seen explosive growth, with market size increasing annually. The United States leads as the largest consumer market for pets, followed closely by Europe and East Asia.

According to PetKeen, the current global pet market is valued at $261 billion, with the U.S. commanding half of this market share. Statistics from the American Pet Products Association indicate that over the past 30 years, pet ownership in the U.S. has risen from 56% to 68%, with approximately 85 million households owning pets.

Furthermore, with millennials and Gen Z consumers coming of age, there is a higher acceptance and affection for pets compared to previous generations. In 2020, about 60% of young American families owned pets, while households headed by baby boomers accounted for 30%.

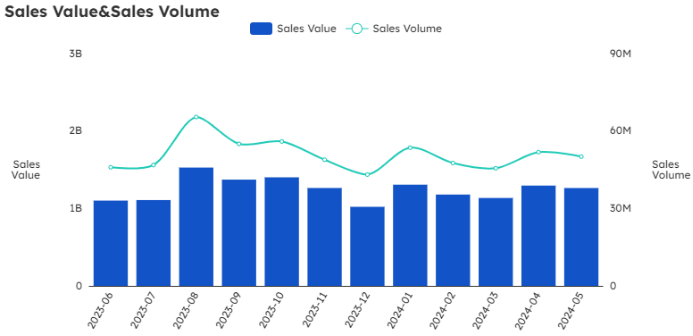

This content focuses on the development trends of the U.S. Amazon platform's pet products market based on Moojing oversea data, analyzing how overseas brands can stand out in intense competition.

Dogs and cats dominate the global pet market, celebrated for dogs' adaptability and diverse breeds, and cats' rising popularity in the U.S. for their low-maintenance companionship, aligning well with modern lifestyles.

As the number of people choosing dogs and cats as daily companions continues to rise, markets for pet food, grooming, toys, and healthcare are expanding further.

According to Moojing oversea data, the pet products category on the U.S. Amazon platform reached a market size of USD 15 billion over the past year, showing a 21% year-on-year growth. Dog and cat products accounted for 91.4% of the market share, firmly leading the entire pet products market.

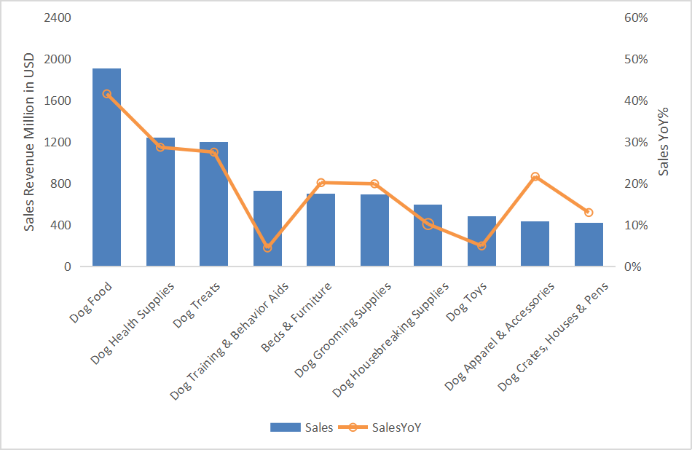

In the dog products category, dog food, health supplies, and dog treats are the top three popular items. The use of organic and natural materials and customized services are highly favored in the U.S. market, driven by increasing attention to pet care and rising expenditures on animal health.

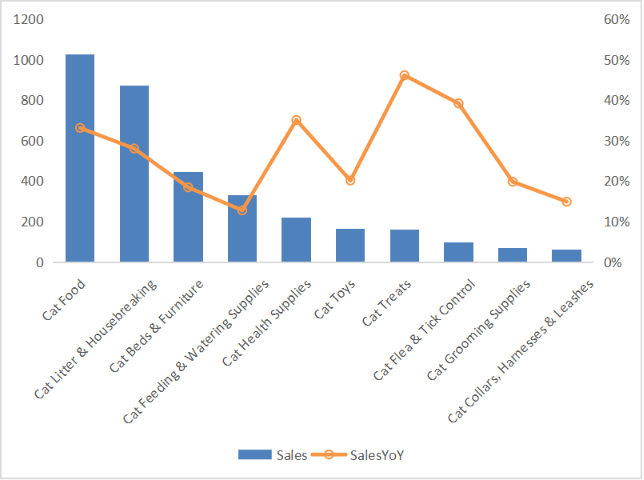

According to Mordor Intelligence, the compound annual growth rate of segmented markets for feline pets is expected to reach 5.3% from 2022 to 2030.

In the U.S. Amazon platform's cat products category, cat food, litter and litter boxes, and cat beds are the top three products. As the number of pet owners increases, there is a growing trend towards spending more on service packages, including food and grooming choices. Demand in the market is driving further upgrades in pet products, with a significant influx of high-end and specialized offerings in pet care, furniture, and more.